Why My Success-Based Fee Structure Works in Your Favor

When choosing an independent appraiser to appraise your vehicle and represent you in the appraisal clause process, it’s essential to understand not just the fee structure, but the quality of service and results you’ll receive.

My pricing model includes a $300 fee for a detailed, USPAP-compliant appraisal, plus a 20% success fee based solely on how much I increase your settlement offer. This structure works in your favor and ensures I’m just as motivated as you are to get you the most fair payout possible.

Plus, if I don’t increase the insurance company’s offer by at least $1,000, I’ll refund your $300 fee, so there’s no risk in hiring me.

1. Motivation to Maximize Your Settlement

The 20% success fee means I’m financially motivated to fight for every dollar you’re entitled to. Many appraisers charge a flat fee, but here’s the problem:

Say the insurance company is offering you $17,000 for your car, and your flat-rate appraiser values it at $22,000. If the opposing appraiser proposes settling at $18,000, your appraiser has little reason to keep pushing. He or she gets paid the same either way and can just move on to the next one. With a success-based model, I’m motivated to push for every justified dollar, because we both benefit.

I don’t just submit a number and hope for the best. I carefully review the opposing appraiser’s report, challenge flawed comps and questionable condition adjustments, and push back on some of the common tactics I see.

These include using comparables that are rental return vehicles, comps from rust belt states with potential corrosion issues, or listings that are missing key options. I’ll even contact sellers to verify important details like tire condition, accident history, and whether the vehicle is still available. Every detail counts when you’re fighting for a fair payout.

Over 95% of my cases are resolved without needing an umpire because my reports are respected in the industry. But if one is needed, choosing the right umpire is crucial.

Some umpires rely on referrals from appraisers who may not be entirely impartial. I always take extra care to make sure we agree on someone truly neutral, so the process stays fair.

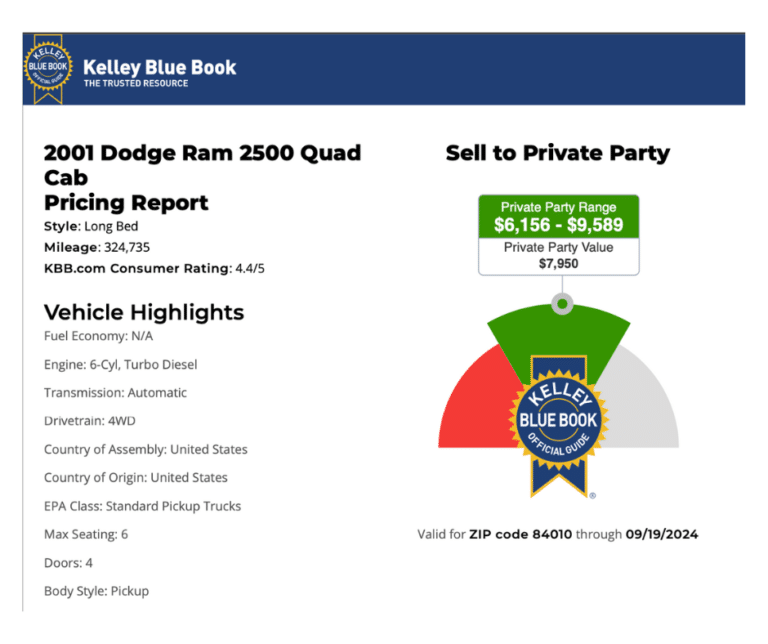

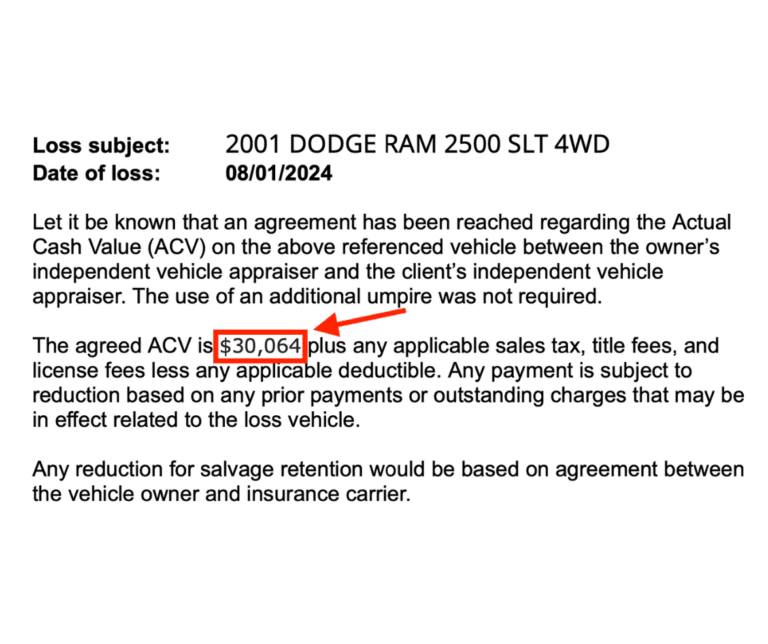

2. Run, Don’t Walk, Away from Appraisers Using Blue Book Values

If an appraiser bases their opinion on values from Kelley Blue Book, JD Power, or NADA, consider that a serious red flag. Those guides often overlook essential factors that determine your vehicle’s true worth, especially if it’s a classic, rare, or equipped with special features, etc. Nothing is more accurate than using actual, substantially similar vehicles that are currently for sale or were recently sold. These reflect the true market dynamics better than any blue book value ever could. Here are some real-world examples of where these “blue book” values fell short compared to the settlements I achieved:

-

2001 Dodge Ram 2500 Cummins Turbo Diesel: Kelley Blue Book said $7,950. I got my client $30,064.

-

2011 Lexus GX 460: Kelley Blue Book said $13,221. I got my client $18,355.

-

2019 Ford Mustang GT Premium: Kelley Blue Book said $30,222. I got my client $36,200.