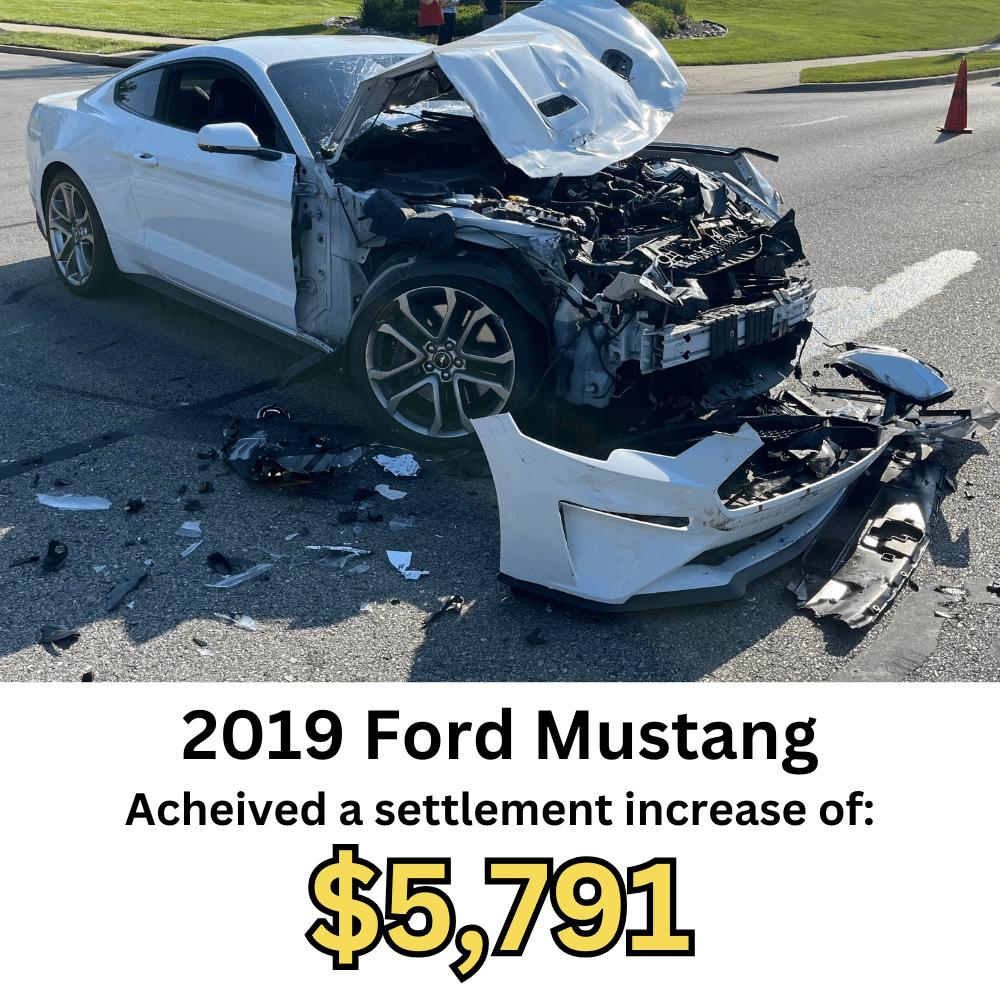

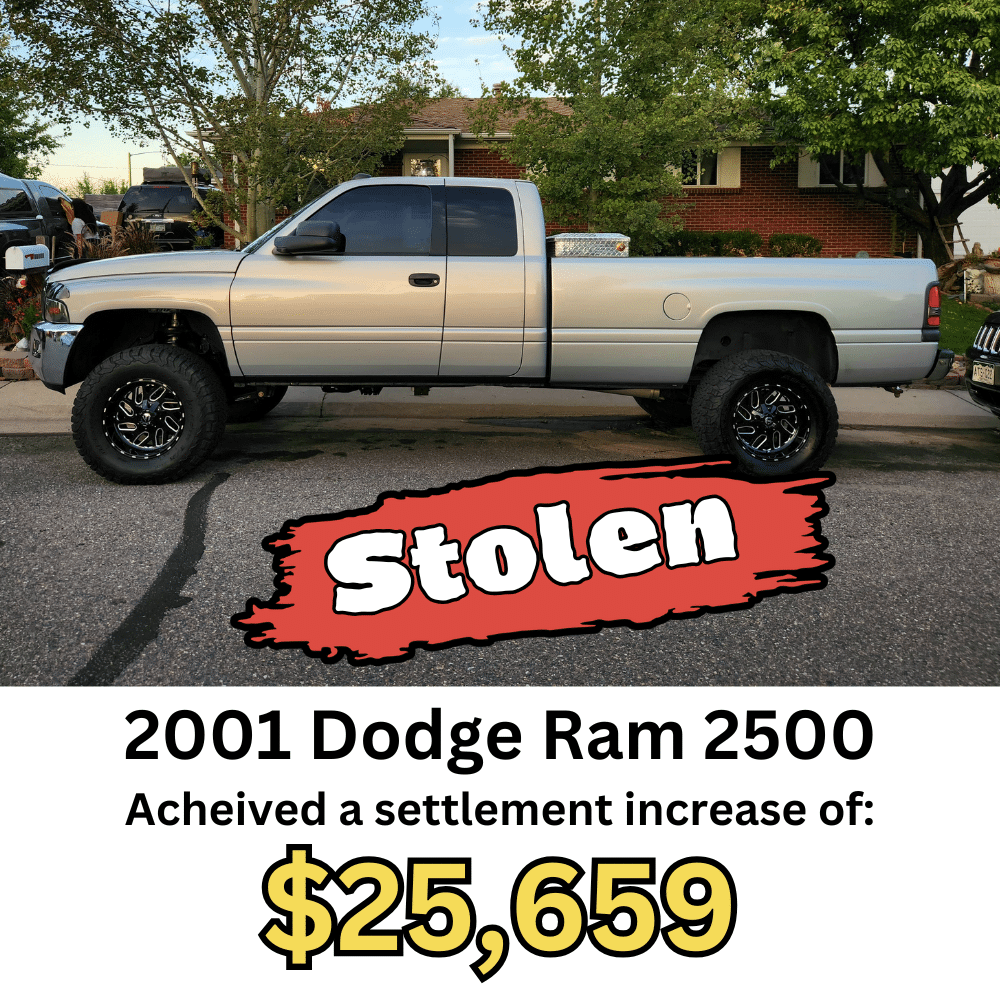

Totaled or stolen car? Sometimes, insurance companies offer a lot less than your vehicle was actually worth. As an independent vehicle appraiser specializing in appraisal clause cases, I help you keep the insurance company honest.

My Story

Fair Auto Appraisals LLC was born out of my personal frustration with insurance companies’ lowball tactics – something I experienced not once, but twice. In 2012, I lost my mint condition 1992 Toyota Pickup in a rollover accident on an icy road, and in 2023, I lost my 1998 Dodge Ram with a 12 Valve Cummins motor to an engine fire. Both times, I faced significantly undervalued offers for the vehicles.

The dispute processes were long and grueling, and I believe they’re designed to wear people down until they accept less than they deserve. But I refused to give up. I fought hard and ultimately secured fair settlements both times. Those experiences ignited a passion in me to help others fight for what is simply just fair.

We all pay a lot into insurance every month, so it’s only fair that they are there for us when we actually need them. It’s easy to feel powerless against their claims adjusters, but you have rights. I’ve been in your shoes, and as an independent vehicle appraiser certified by the American Society of Certified Auto Appraisers (ASCAA), I’m dedicated to fighting for fair payouts for my clients.

My goals are simple: to provide you with unbiased, accurate, and well-documented appraisals, and to expertly represent you throughout the appraisal clause process, ensuring that you are made whole after an insurance claim.

Appraisal Clause Service

You don’t have to accept your insurance company’s lowball offer

Diminished Value Service

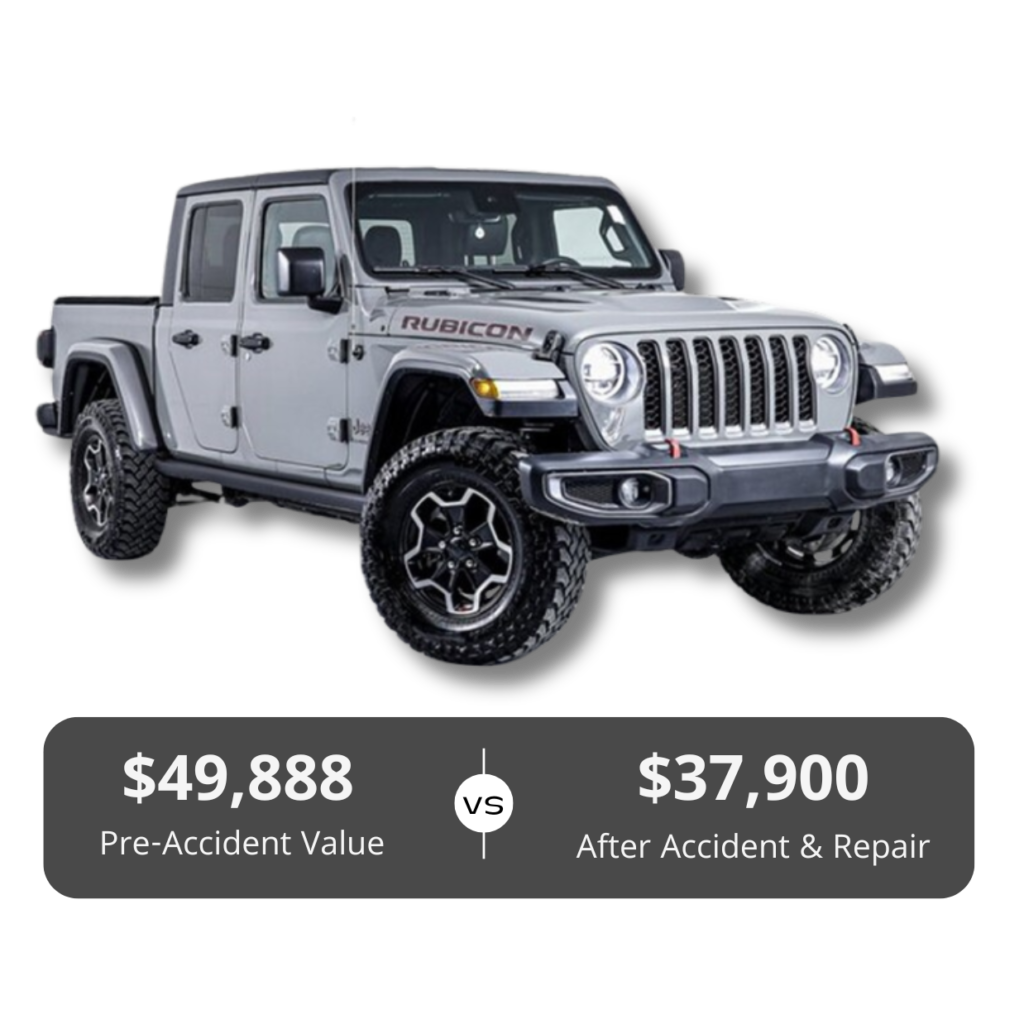

Diminished value refers to the loss of value a vehicle experiences after it has been involved in an accident, even after it has been fully repaired

Pricing

Zero Risk Money Back Guarantee:

If I accept your case and you follow my recommended procedures to dispute the insurance company’s valuation or to recover your diminished value … but fail to collect more than your insurance company’s inital offer, you will receive a full refund and you will not be charged any money for my services

-

$200 upfront for a Detailed, USPAP-Compliant Appraisal: This report is approximately 40+ pages and it includes adjustments for make, model, year, mileage, options, condition, market & location. Also, special consideration is taken into account for rare models, special features and classics, etc. This fee is fully refundable if I do not succeed in increasing the insurance company’s offer so there is zero risk to you in challenging their offer.

Plus

-

10% Success Fee for Appraisal Clause Representation & Negotiations: This fee applies only to the additional amount I secure beyond the insurance company’s offer. It covers the time spent scrutinizing the insurance company appraiser’s report, identifying undervaluations & improper adjustments, and advocating on your behalf to ensure a fair settlement. The success fee is invoiced once the entire process is complete, meaning you only pay if your settlement is increased.

-

$200 Upfront for a Detailed, USPAP-Compliant Diminished Value Report and Demand Letter: This fee covers a comprehensive appraisal of your vehicle’s diminished value, as well as the preparation of a detailed demand letter. This fee is fully refundable if I do not succeed in increasing the insurance company’s offer.

Plus

-

10% Success Fee for Expert Diminished Value Negotiations: This fee applies to the amount of the diminished value settlement that I help you secure. It covers the time spent negotiating directly with the insurance company or coaching you through the process to achieve the best possible outcome. The success fee is invoiced once the entire process is complete, so you only pay if a settlement is obtained.

Frequently asked questions

How does the appraisal process work?

First, we identify advertised or recently sold comparable vehicles in terms of make, model, year, mileage, condition, and specifications.

We consider the original manufacturer specifications, features, and options of the vehicle to determine its intrinsic value. We also take into account any special or rare features that may enhance the vehicle’s desirability and value, such as limited production runs, special editions, or performance upgrades.

Finally, we adjust comparable vehicle values to account for differences in mileage, condition, options, and other relevant factors.

What types of vehicles do you appraise?

We specialize in appraising all types of vehicles, including cars, trucks, SUVs, motorcycles, RVs, semis, classic cars, trailers and more.

What is a value dispute appraisal?

A value dispute auto appraisal is an independent vehicle valuation report that is generally used by a vehicle owner when there is a disagreement between the vehicle owner and their insurance company regarding the value of a damaged, totaled, or stolen vehicle.

What is a diminished value appraisal?

A diminished value appraisal is an independent vehicle valuation report conducted to determine the decrease in the monetary value of a vehicle following an accident or other significant event that causes damage. This decrease in value is often referred to as diminished value.

When a vehicle is involved in a collision or sustains significant damage, even if it’s repaired to a high standard, it may still lose some of its market value due to factors such as the accident history, potential hidden damage, and the perception of buyers. Diminished value can arise from factors like structural damage, cosmetic damage, and repairs that aren’t perfect or fully restore the vehicle to its pre-accident condition.

Why might I want a total loss or diminished value appraisal?

Insurance companies often aim to settle claims for the lowest possible amount. Having an independent appraisal can help ensure that you receive fair compensation for your total loss vehicle or for the diminished value of your repaired vehicle.

How is diminished value calculated?

Diminished value is calculated based on various factors, including the severity of the damage, the quality of repairs, the vehicle’s age and mileage, and market conditions. Fair Auto Appraisals LLC uses industry-standard methods to calculate the diminished value accurately.

Can I challenge my insurance company's settlement offer?

Yes, you have the right to challenge your insurance company’s settlement offer if you believe it is unfair. Our appraisal services can provide you with the evidence and documentation needed to support your claim and negotiate for a fair settlement.

How long does the appraisal process take?

Most valuation reports are returned within 24 hours of receipt of payment & all of the necessary vehicle information & details that are requested

Are your appraisals accepted by insurance companies?

Our appraisals are conducted in accordance with industry standards and are widely accepted by insurance companies. However, if there are any issues with acceptance, we can provide additional documentation and support to facilitate the claims process at no additional cost.

Free 2nd Opinion

Before founding Fair Auto Appraisals LLC, I found myself navigating the appraisal clause process firsthand. When it came time to hire an appraiser, I knew that I wanted to work with an appraiser who answered all of my questions in a timely manner and who would provide a professional looking, well documented valuation report.

The biggest challenge for me was that I couldn’t preview different appraisers’ reports without committing and paying for one. I ended up paying for an appraisal only to be disappointed by the quality of the work. Frankly, the appraiser took 10 days and in the end the report resembled the work of a fifth-grader! To make matters worse, my insurance company dismissed it entirely because the appraiser did not break down the value adjustments that were applied to each comparable. When I requested revisions to the appraisal, the appraiser demanded additional fees—needless to say I was very disappointed.

This experience drove home the importance of providing my clients with top-tier valuation reports, supported by at least three comps with value adjustments applied for differences in mileage, condition, options and upgrades. Also taken into account are any special or rare features that may enhance the vehicle’s desirability and value, such as limited production runs, special editions, or performance upgrades.

I approach every appraisal with the mindset that it could end up being scrutinized by a judge.

I would be happy to review your scenario for free, just fill out the form to the right and if you would like me to send you a sample of one of my appraisal reports you can check the box next to that option and I will email you a copy.

Zero Risk Money Back Guarantee:

If I accept your case and you follow my recommended procedures to dispute the insurance company’s valuation or to recover your diminished value … but fail to collect more than your insurance company’s inital offer, you will receive a full refund and you will not be charged any money for my services