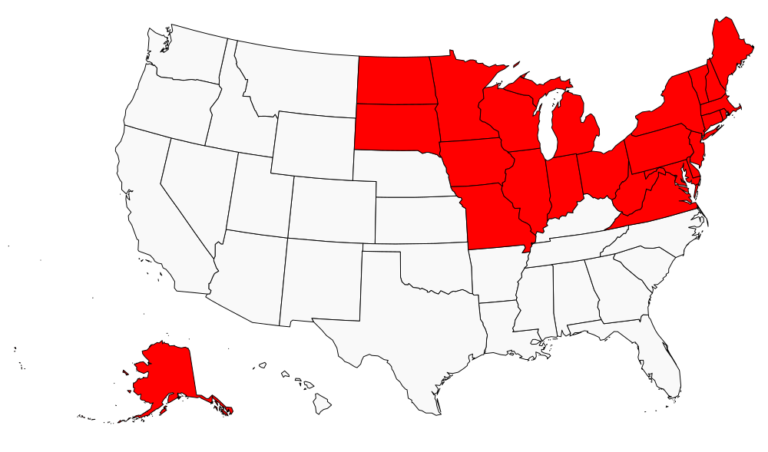

What is the Salt Belt?

The term “Salt Belt” typically refers to regions in the United States known for heavy use of road salt in the winter to control ice & snow. States like Alaska, Connecticut, Delaware, Illinois, Indiana, Iowa, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, North Dakota, Ohio, Pennsylvania, Rhode Island, South Dakota, Vermont, Virginia, West Virginia, Wisconsin, and Washington DC are often included in this category.

Why Can Comps from the Salt Belt Be Problematic?

Vehicles in the Salt Belt are more prone to rust and corrosion due to harsh weather conditions, road salt usage, and other environmental factors. As a result, cars in these areas may deteriorate more quickly and exhibit more extensive rust damage compared to vehicles in other regions. The rust is not always visible on the body of the vehicle and oftentimes the brake lines, electrical wiring, and structural components are adversely affected.

When insurance companies use comps from the Salt Belt to assess the value of your vehicle after accident, they may seriously undervalue it. Even if the vehicle is now titled and available for sale near your location, it may have spent most of it’s life in a Salt Belt state. A car with rust damage can be worth significantly less than a vehicle with no rust, even if it’s mechanically sound and well-maintained.

What You Can Do About It

If you suspect that your insurance company is using comps from the Salt Belt to undervalue your vehicle, don’t hesitate to push back. You have the right to challenge their assessment and demand a fair settlement that takes into account the true condition and value of your car.

If you find yourself in a dispute with your insurance company over the value of your claim, you may have the option to invoke the appraisal clause. This clause allows for an independent appraisal of the property or item in question by a neutral third party. When hired by my clients, I pull VIN reports on every comp that your insurance company uses in order to determine where those vehicles have spent most of their lives. I am happy to review your scenario for free, if you would like to request a free 2nd opinion you can do that here

It’s important to be aware of your rights and options when it comes to insurance value disputes. If you believe you have received a lowball offer or disagree with the value assigned to your claim, consider hiring a professional who can provide a fair & un-biased appraisal and guide you through the process and help ensure you receive a fair settlement.