When it comes to determining the value of your vehicle, most insurance companies rely on a third-party valuation service called a CCC One Market Valuation Report (The CCC stands for Certified Collateral Corporation) In my experience, the valuation provided by the CCC One report is oftentimes much lower than the true value of your vehicle, especially if your vehicle was a rare model, had special features, or if it was a classic or collectible. In these cases, it is important to know how to effectively dispute the CCC One report. Here are some steps you can take to fight a CCC One report to help ensure that you receive a fair payout for your total loss insurance claim.

1. Review the CCC One Valuation Report

The first step in disputing a CCC One valuation report is to carefully review the report provided by the insurance company. Pay close attention to the details such as the make, model, year, mileage, condition, and any additional features of your vehicle. Make sure all the information is accurate and up-to-date. If you find any discrepancies or errors, document them for your dispute.

2. Scrutinize the Comparables

It is crucial to thoroughly examine the comps used in the valuation process. Begin by scrutinizing the selection criteria for the comps, ensuring they are truly similar in terms of make, model, year, condition, and mileage to your vehicle. Try to find the classified ad listing for each comp. You can do this by googling the dealership that the vehicle is for sale or was sold at or you can try googling the VIN number of the comparable.

Pay close attention to any adjustments made to the comps to account for differences, such as mileage or condition discrepancies. Also, assess the geographic relevance of the comps – are they from the same market area as your vehicle?

If the comps are near to where you live, consider visiting them in person and take notes and photos if the vehicle is in worse condition than yours or if it needs any repairs, etc. Evaluate whether any outliers or inaccuracies exist among the comps that could skew the valuation.

If you can’t find any record of the comparable online at all, then that comp should be thrown out. It would be unfair to use comps that can’t be fully vetted by all parties.

By meticulously analyzing the comps, you can identify discrepancies and inaccuracies that may warrant further discussion or dispute with the valuation provider.

3. Get a Second Opinion

If you have a CCC One report that you feel is unfair, I would be happy to review it for free and give you my unbiased opinion. You can order a free 2nd opinion by following this link: https://fairautoappraisals.com/free-2nd-opinion/

4. Gather Evidence

Collect as much evidence as possible to support your dispute. This can include recent maintenance records, receipts for any recent repairs or upgrades, photographs of your vehicle showing its condition before the accident, and any other relevant documentation. The strongest piece of evidence to support a fair valuation is a well documented appraisal from an un-biased, independent appraiser. The more evidence you have, the stronger your case will be. If you are ready to order an appraisal, you can do so by following this link: https://fairautoappraisals.com/order-appraisal/

5. Communicate with Your Insurance Company

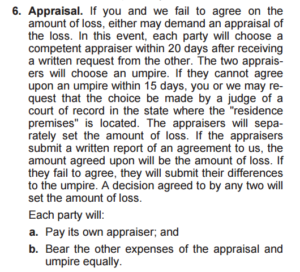

Reach out to your insurance company and express your concerns regarding the CCC One valuation report. Find out if your policy has an “appraisal clause” or “appraisal provision”. You can find this out by directly asking the insurance adjuster. If the information you receive is unclear or unsatisfactory, don’t hesitate to escalate the issue by asking to speak with a manager or supervisor. You can also ask for a copy of your policy provisions. Within your policy provisions, you can usually find the procedure for when there is a disagreement about the value of your total loss in the “damages”, “damage to your vehicle”, “loss settlement” or “payment for loss” module of the contract. Here is an example of a typical appraisal clause:

Most insurance policies have an appraisal clause, but even if your policy does not have one, you can still dispute the insurance company’s offer. Read & understand the relevant section of your contract and then provide them with the evidence you have gathered and explain why you believe the report is inaccurate or undervalued. Be polite but firm in your communication, and keep a record of all correspondence.

6. Request a Revaluation

Ask your insurance company to conduct a revaluation of your vehicle. Provide them with the evidence you have gathered and request that they consider it in their reassessment. Be sure to follow up with your insurance company to ensure that your request is being processed.

7. Consider Hiring an Attorney

If you are unable to reach a satisfactory resolution with your insurance company, you may want to consider seeking legal assistance. An attorney experienced in insurance claims can provide guidance and help you navigate the dispute process.

8. File a Complaint

If all else fails, you can file a complaint with your state’s insurance regulatory agency. They can investigate your case and help mediate a resolution between you and your insurance company.

Remember, disputing a CCC One valuation report requires patience and persistence. Stay organized, gather as much evidence as possible, and maintain clear and effective communication with your insurance company. By following these steps, you can increase your chances of successfully fighting a CCC One valuation report and obtaining a fair settlement for your total loss insurance claim.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered legal advice. Consult with a qualified attorney or insurance professional for advice specific to your situation.